Global Blue is one of the leading international companies providing VAT refund (Tax Free) services for travelers shopping outside their country of residence. The company operates in more than 50 countries worldwide, offering tourists a convenient system for getting back a portion of the money spent on their purchases.

What is Tax Free?

Tax Free Shopping is the opportunity to get a refund on a portion of the money spent on purchases abroad in the form of a value-added tax (VAT) reimbursement. In some countries, VAT rates can range from 10% to 25%, making the refund quite beneficial.

The Tax Free program applies to non-residents of the country who purchase goods for non-commercial purposes (i.e., for personal use) and then take them out of the country.

How does Global Blue work?

The Global Blue system simplifies the tax refund process and works as follows:

1. Purchasing goods. When shopping at a store that partners with Global Blue, inform the salesperson that you want to use the Tax Free option. You will receive a special Global Blue Tax Free Form along with your purchase receipt.

2. Export validation. At customs (usually at the airport) before departure, you must show your goods, receipt, and passport. The customs officer will stamp your form, confirming that the goods are being exported from the country.

3. Getting your refund

After that, you can:

- Receive cash at a Global Blue refund point (available in some airports);

- Have the refund issued to a bank card, credit card, or by check sent via mail;

- Use the Global Blue mobile app (if supported in that country).

How much can you get back?

The refund amount depends on:

- The VAT rate in the country of purchase.

- The minimum purchase amount required for Tax Free eligibility (varies by country);

- The Global Blue service fee, which is deducted from the refund.

Example: If the VAT rate in a country is 20%, the actual refund you receive will be approximately 12–14% after deducting the service fee.

Where does Global Blue operate?

The company partners with thousands of stores across Europe, Asia, the Middle East, and Australia. The most popular countries for Tax Free refunds through Global Blue include: Italy, France, Spain, Germany, Austria, Sweden, Japan, South Korea, Thailand, and others.

Benefits of using Global Blue

- Convenience: A standardized system that works worldwide.

- Speed: Fast refund options at the airport or online.

- Accessibility: Thousands of partner stores marked with the Global Blue Tax Free sign.

How Global Blue works in Spain

In Spain, there is no minimum purchase amount required to qualify for Tax Free refunds. Even small purchases can be eligible if they meet certain conditions.

VAT rates in Spain:

- 21% — standard rate

- 10% — food products, optical goods

- 4% — medicines, books, magazines

Who is eligible: Persons residing permanently outside the EU.

What is refundable: Goods not used before leaving the EU and taken in personal luggage.

What is not refundable: Services and goods consumed within the EU.

Tips:

1. Always present your passport or proof of residence with a photo.

2. Provide your contact details to receive instructions in your language.

3. Global Blue participants can scan a digital barcode in the store to automatically fill in personal data on the form.

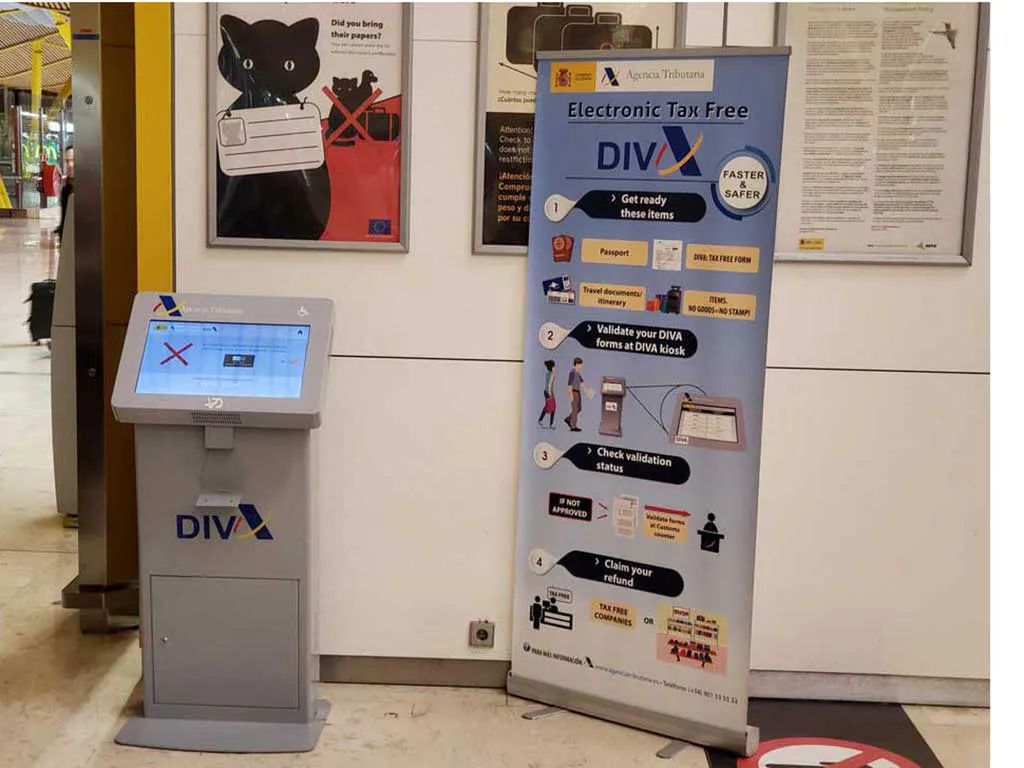

Validation for refund: You must have your Tax Free form stamped by customs when leaving the EU. Spain uses the DIVA system — digital scanning for quick validation.

How to use DIVA:

- Locate a DIVA kiosk at the airport or seaport.

- Scan the barcode on your Tax Free form.

- Wait for confirmation on the screen (positive validation means you can receive the refund).

Validation timing: Up to 3 months from the purchase date plus the current month.

Form validity: 4 years from the issue date (for possible dispute or verification).

Important: If you leave the EU not from Spain, do not use DIVA in Spain. Validate the form in your last Schengen country of stay.

Required documents for refund in Spain:

- Passport

- Tax Free form with customs stamp or DIVA confirmation

- Original purchase receipt

Refund points: Located in major Spanish airports (Madrid, Barcelona, etc.), train stations, shopping centers, or via mail.

Global Blue service at Downtown Duty Free Shop in Madrid

Downtown Duty Free is a retail store located within the city that offers Duty Free and Tax Free products for international travelers. Unlike traditional duty-free shops at airports, city-center duty-free stores allow customers to shop in a more relaxed environment before heading to the airport.

It’s worth noting that the Global Blue refund system operates at the Downtown Duty Free shop in Madrid!

Mydutyfree — pre-order service at Downtown Duty Free Shop in Madrid

Order Duty Free products online without interrupting your city strolls, and pick up your pre-packed order at the store. All you need to do is choose products online, place your pre-order, and collect it at our partner’s shop located at ZURBARÁN, 30.

How to use the pre-order service at Downtown Duty Free shop in Madrid?

1. Visit the Mydutyfree site or use the app and select Madrid as your location.

2. Choose the products and add them to your cart.

3. Select a convenient date and time for order pickup.

4. Your order will be waiting for you at the Downtown Duty Free shop on the specified date.

5. When picking up your order, provide your order number and show your flight ticket.

Enjoy pleasant and profitable shopping with Mydutyfree!